Discounted payback period financial calculator

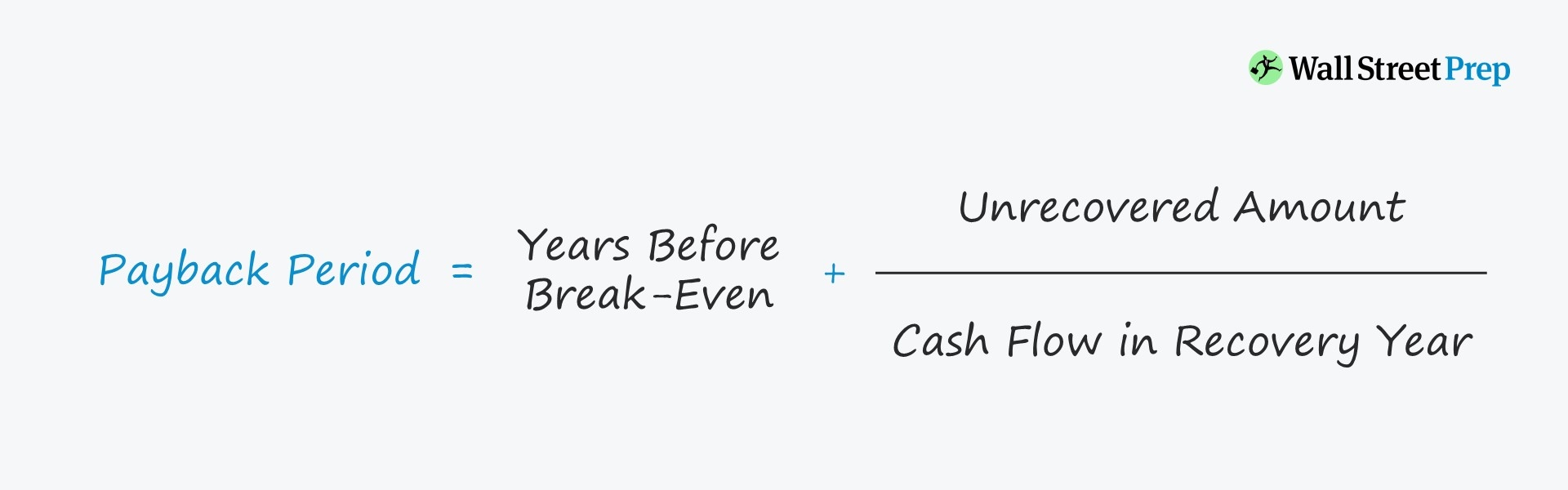

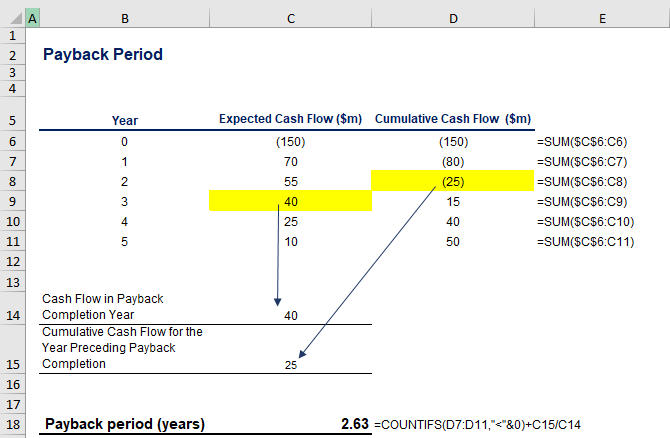

Payback Period 3 1119 3 058 36 years. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

What Is The Discounted Payback Period 365 Financial Analyst

Accounts Payable 30 million.

. R R f β R m R f. ICalculator focuses on making your calculations easy so the calculator you will use will help you in many ways like. Suppose a company has an accounts payable balance of 30mm in 2020 and COGS of 100mm in the same period.

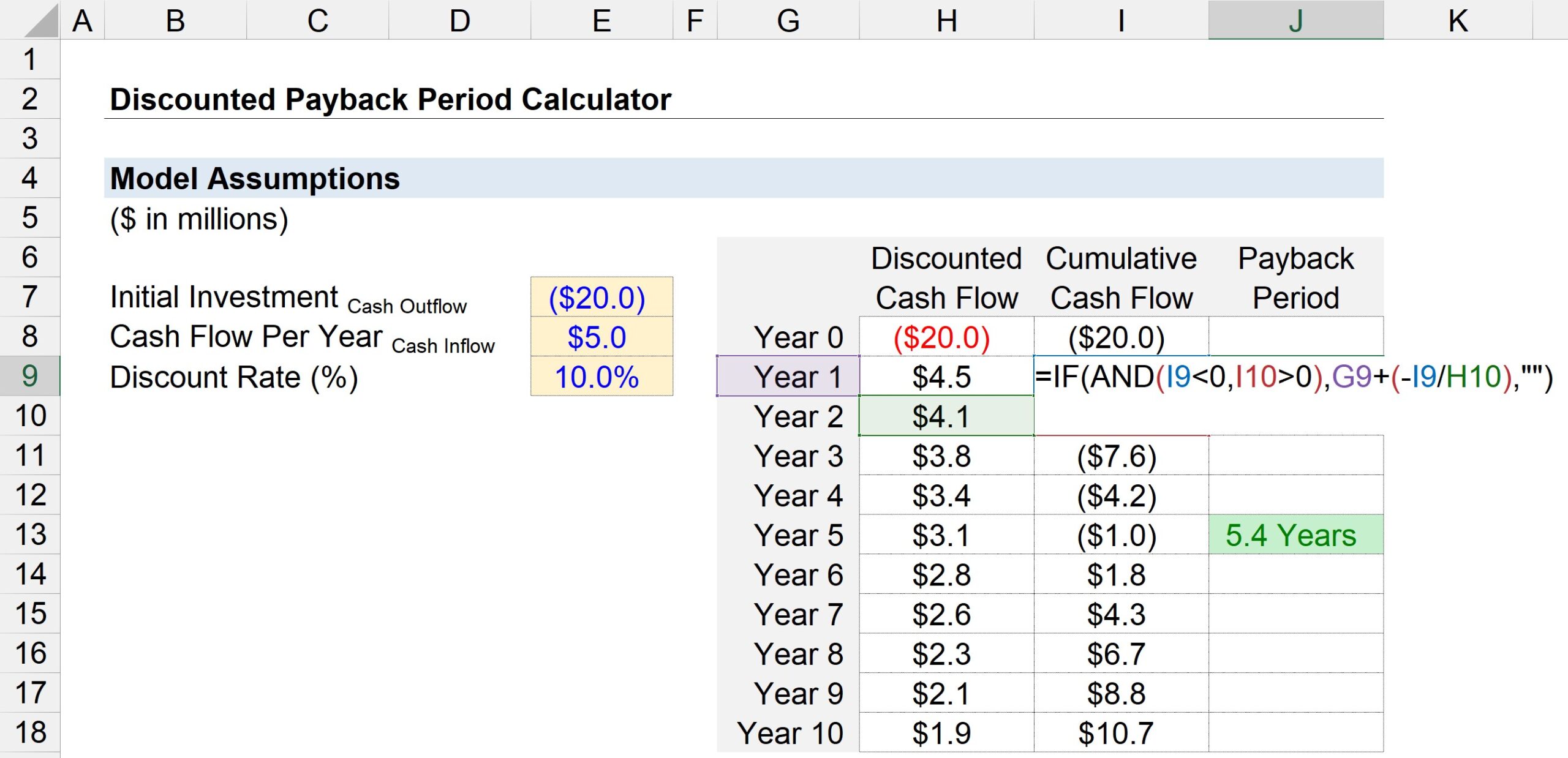

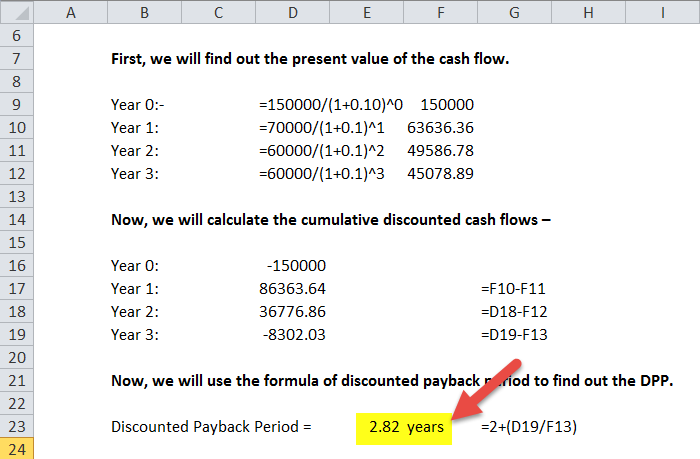

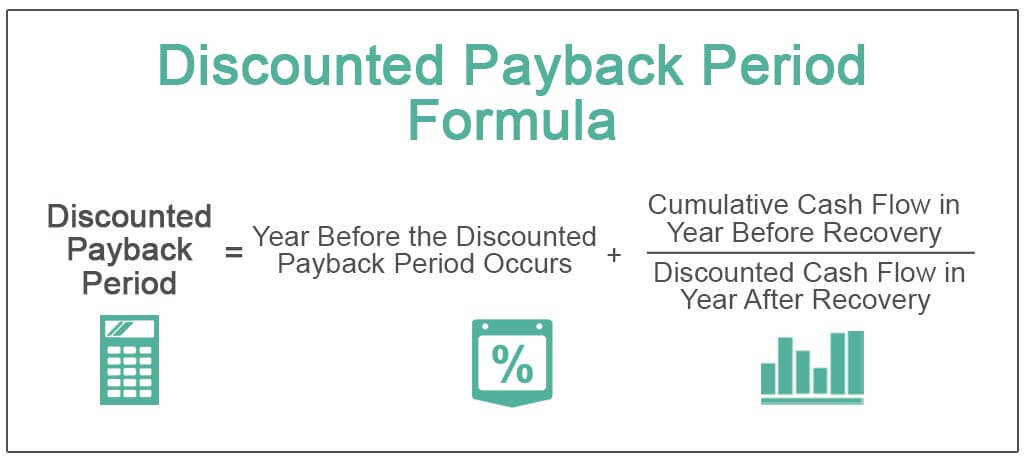

10mm Cash Flows Per Year. When deciding whether to invest in a project or when comparing projects having different. Discounted payback period will usually be greater than regular payback period.

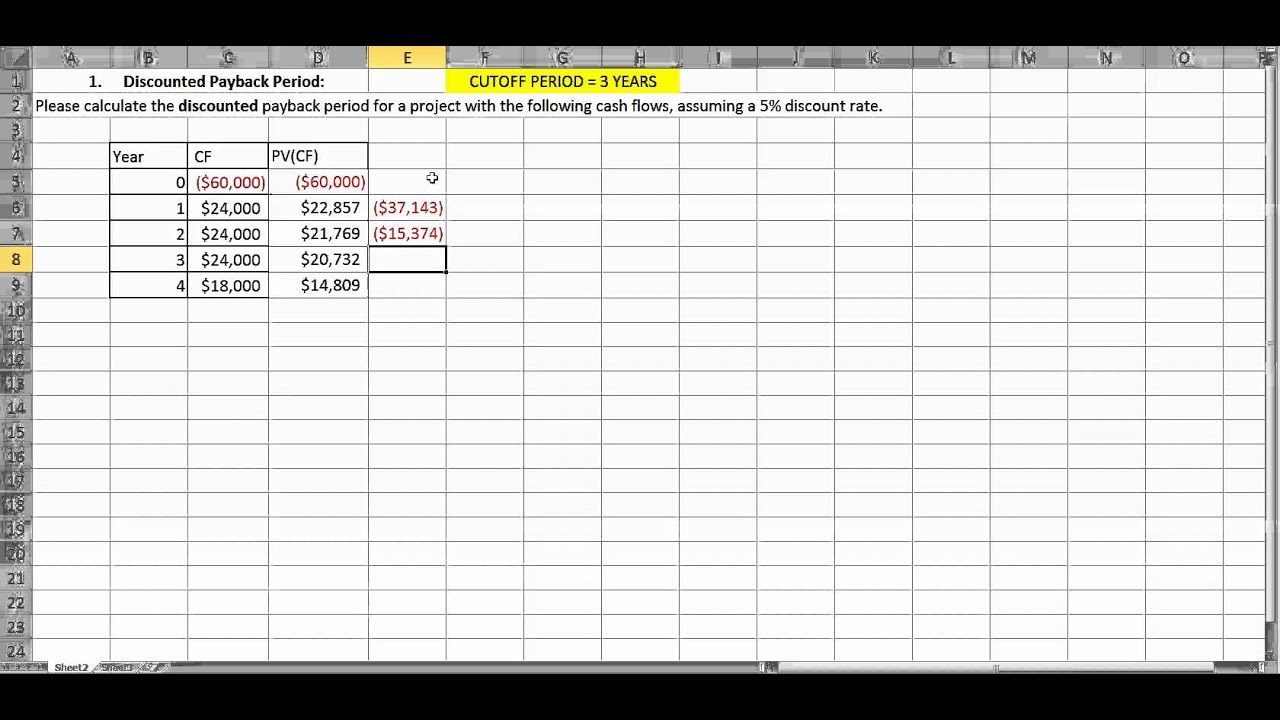

This finance charge calculator estimates your credit cards or loans finance charge youll see on the billing statement by considering the amount owed APR cycle length. Payback Period Example Calculation. Discounted Payback Period Calculator.

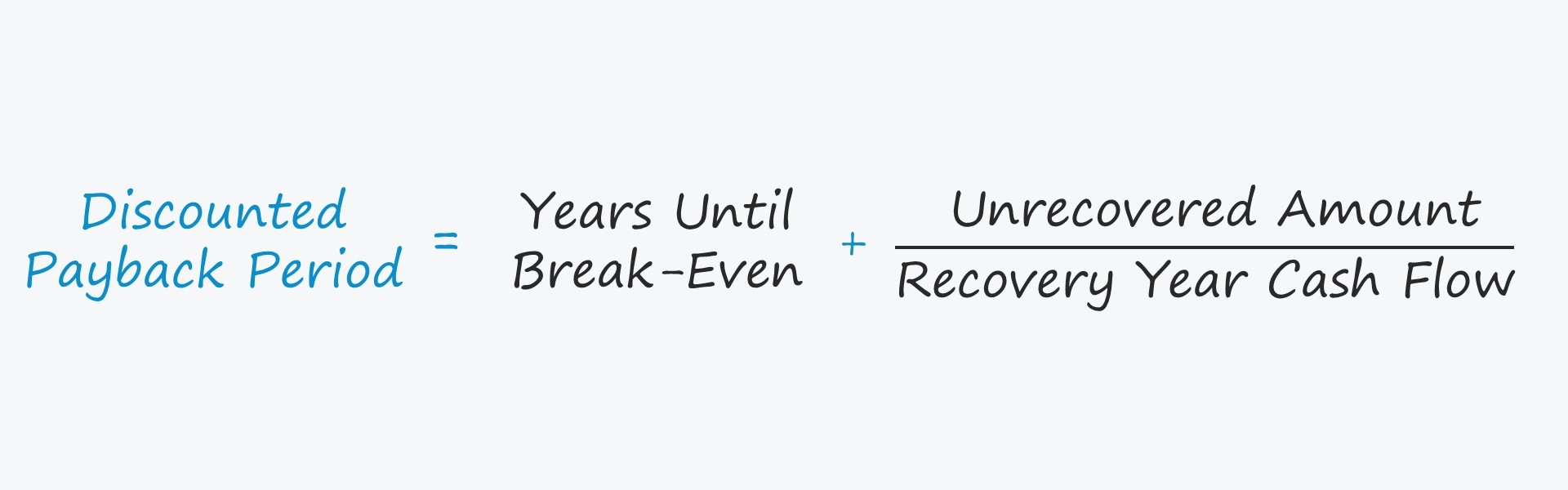

I use the word might here because at what rate the cash flows of both projects A and project B will be discounted is to be seen. Calculate Discounted Payback Period. An annuity is a fixed sum of money paid someone each period typically for the rest of their life.

Cost of Debt COD is estimated by adding a risk premium to the risk-free interest rate and deducting. If you need to calculate the. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period.

The formula adds up the negative cash flows after discounting them to time zero using the external cost of capital adds up the positive cash flows including the proceeds of reinvestment at the external reinvestment rate to the final period and then works out what rate of return would cause the magnitude of the discounted negative cash flows at time. In fact sometimes this calculator is also known by the name discounted cash flow calculator. The weighted average cost of capital is a weighted average of the cost of equity debt and preference shares.

NPV Net Present Value - sum of discounted net cash flows PI Profitability Index - investment profitability IRR Internal Rate of Return - internal rate of return DPP Discounted Payback Period - discounted payback period Value of discounted net cash flow for each period. Time saving - The calculator is online easy to use with just 3 basic entries required to know the actual cost of your loans. COGS 100 million.

You should take into account all of the financial information available to make an investment decision. Option 2 which has the highest sum of non-discounted cash flows does in fact not even yield the required return rate of 12. Benefits of using the accrued interest calculator.

Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. Net income helps to measure and calculate earnings per share the profitability of the company and helps the investor to take the decision of investment. Moreover the advantages of using such a.

Wikipedia defines the MIRR as. It is better known as Overall WACC ie the overall cost of capital for the company as a whole. In other words it is used to value stocks based on the future dividends net present value.

But yes NPV considers all the cash flows that you. DDM DDM The Dividend Discount Model DDM is a method of calculating the stock price based on the likely dividends that will be paid and discounting them at the expected yearly rate. In the formula the -C 0 is the initial investment which is a negative cash flow showing that money is going out as opposed to coming in.

It is a tool that is used frequently by investors but is by no means the only measure of a companys financial future. NPV will consider this 4000 and might as well say that project B appears smarter. The longer the payback period of a project the higher the risk.

With a payback period of 471 this option achieves a full amortization in less than 5 years which can be a reasonable time horizon for many organizations. Thanks to the calculator we can calculate. Just found your ultimate financial calculator link which looks like may the solution for this.

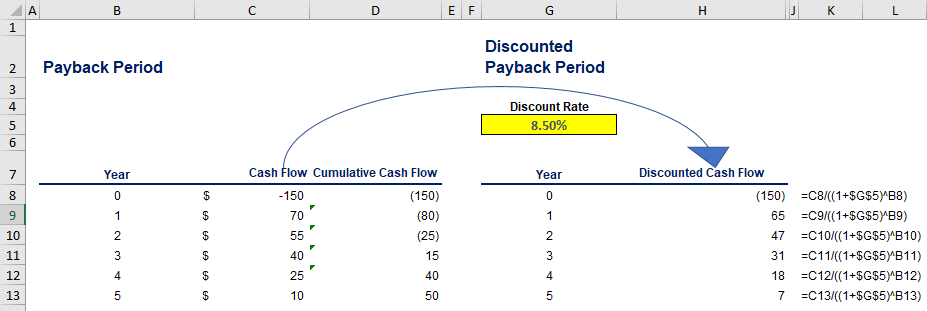

The discounted payback period of 727 years is longer than the 5 years as calculated by the regular payback period because the time value of money is factored in. First well calculate the metric under the non-discounted approach using the two assumptions below. 4mm Our table lists each of the years in the rows and then has three columns.

Usually people treat it as an aggregated or assimilated cost of the financial product they use as it proves to be treated. Here what the payback period is ignoring is the huge cash flow of 4000. Where R is Required ReturnDiscount Rate R f is equal to the risk-free rate of an investment β equals stocks beta R m equals overall stock market risk.

Cost of Equity COE is estimated by using the Capital Asset Pricing Model CAPM. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. Through these analyses one can measure the financial health and financial position of the company.

The earnings per share ratio will help that investor understand the capacity a company has for higher dividends in the future. Investments with higher cash flows toward the end of their lives will have greater discounting. Net Present Value - NPV.

Considering that the money going out is subtracted from the discounted sum of cash flows coming in the net present value would need to be positive in order to be considered a valuable investment. Net income also tells stakeholder whether the company will be able to pay dividend or not. And the weights are the percentage of capital sourced from each component respectively in market value terms.

In addition the companys COGS is anticipated to grow 10 year-over-year YoY through the entire projection period. NPV is used in capital. COGS Growth Rate 10 YoY.

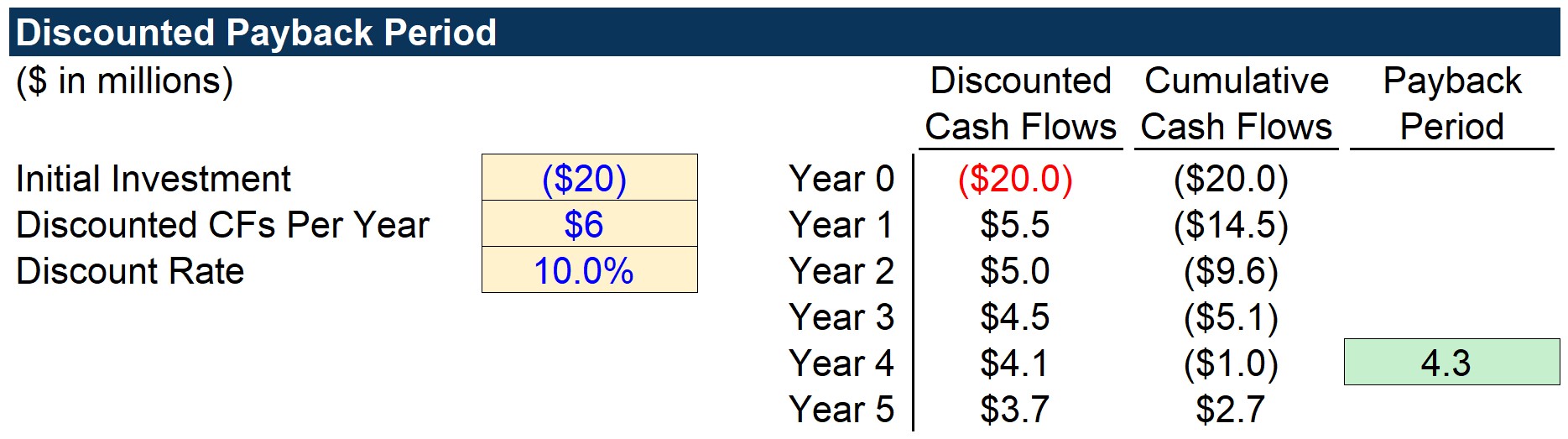

Discounted Payback Period Formula And Excel Calculator

Undiscounted Payback Period Discounted Payback Period

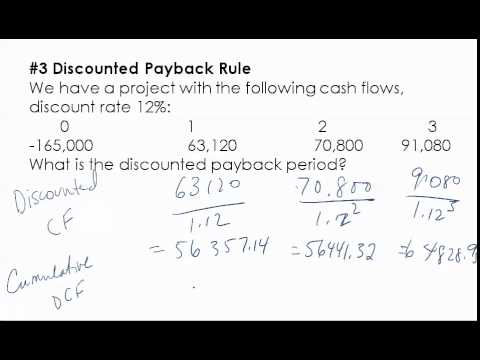

Discounted Payback Period Mp4 Youtube

Ba Ii Plus Calculate Payback Period Npv Irr Pi Youtube

Discounted Payback Period Formula And Excel Calculator

Discounted Payback Period Formula And Excel Calculator

Computing Discounted Payback Period 8 3 Youtube

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Discounted Payback Period Formula With Calculator

Payback Period Formula And Calculator Excel Template

Payback Period Formula And Calculator Excel Template

Payback Period With Baii Plus Note With Professional Ba Ii Plus Youtube

Discounted Payback Period Meaning Formula How To Calculate

What Is The Discounted Payback Period 365 Financial Analyst

Discounted Payback Period Example 1 Youtube

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel